How to peek 6 months into the future of work

Exploring a new-ish economic indicator, and how it might indeed help us make better jobs forecasts

The job market of August 2024 appears to be at a crossroads. Will the Fed’s pivot from fighting inflation to keeping a strong labor market be successful? And how much is AI really affecting the job market? To get a more informed perspective on these issues, it’s helpful to look beyond the latest jobs numbers and consider other indicators that can help us peer further into the future.

One indicator we can rely on: before people are laid off, companies usually cut back on hiring. The Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) captures job openings, hires, quits, layoffs, and other separations. It’s typically published a few days before the Employment Situation (AKA the monthly jobs report). The catch is that it only includes the previous month and is broken down by broad industry. So as of late August, we have July employment numbers by detailed industry, but our latest indicator of where job openings and hiring stands is from June.

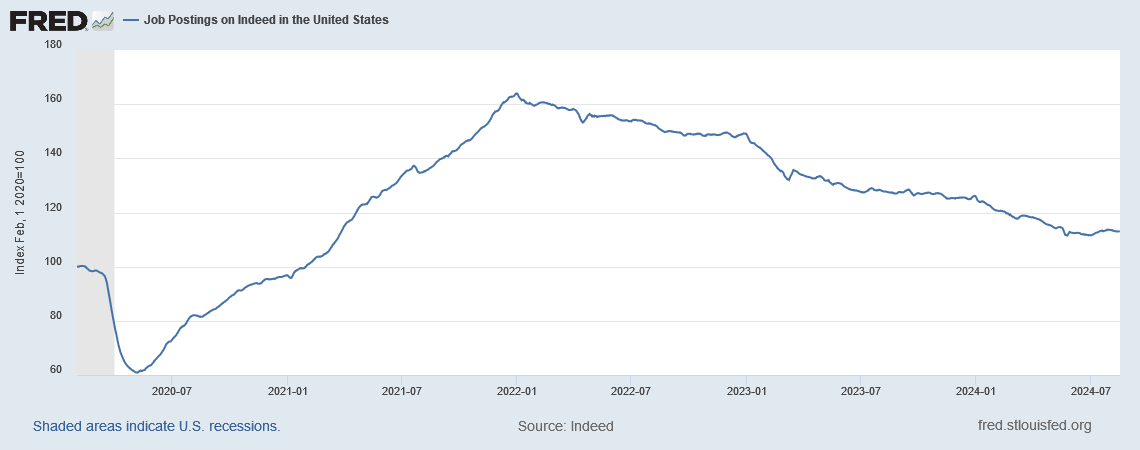

Fortunately, we have another data source this is regularly updated on a roughly weekly basis: Job Postings on Indeed.com, both for the United States and several other countries!

As expected, the job market has cooled from the heady days of the pandemic recovery, with job openings at their lowest levels since April 2021. Yet July 2024 saw a small rebound the likes of which haven’t been seen in over two years. Might this give us some optimism?

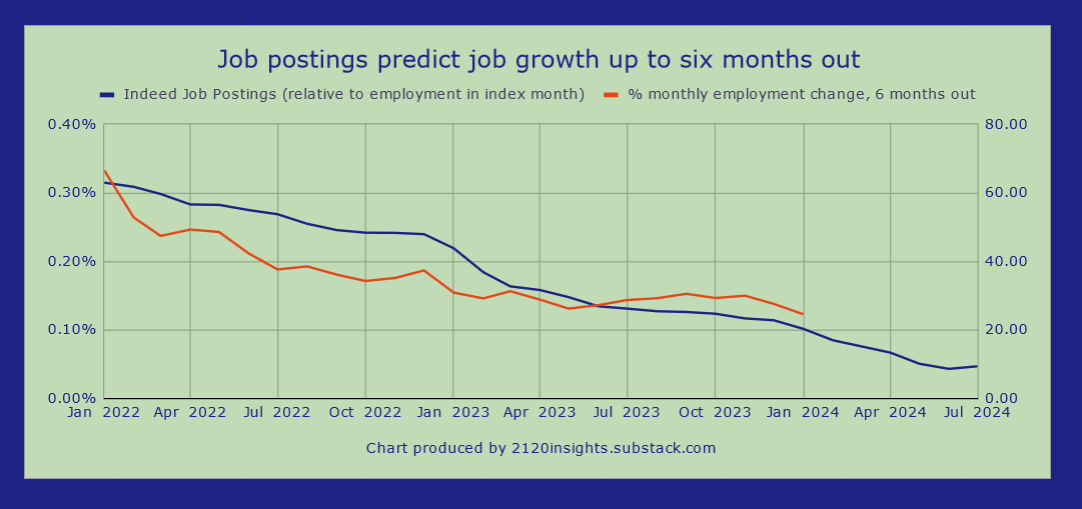

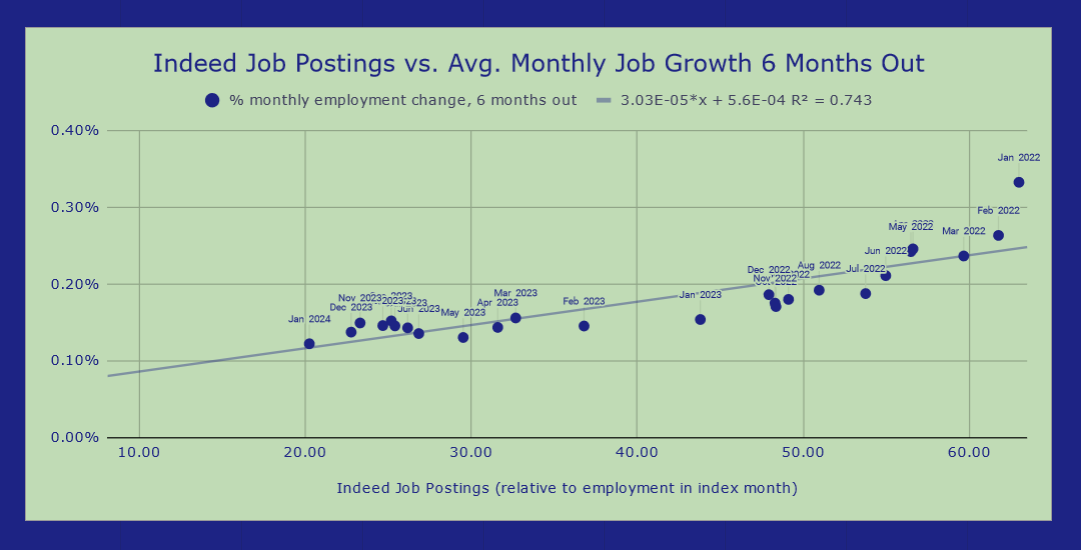

While there are some worries about fake job postings distorting the average, it has been a good leading indicator of the number of job openings reported by JOLTS these past few years. And even more importantly, since 2022, the level of job postings1 on Indeed has reliably forecasted employment growth 6 months out!

A scatter chart reveals the true strength of this relationship. If this trend continues to hold, we might see some better-than-expected jobs reports this fall.

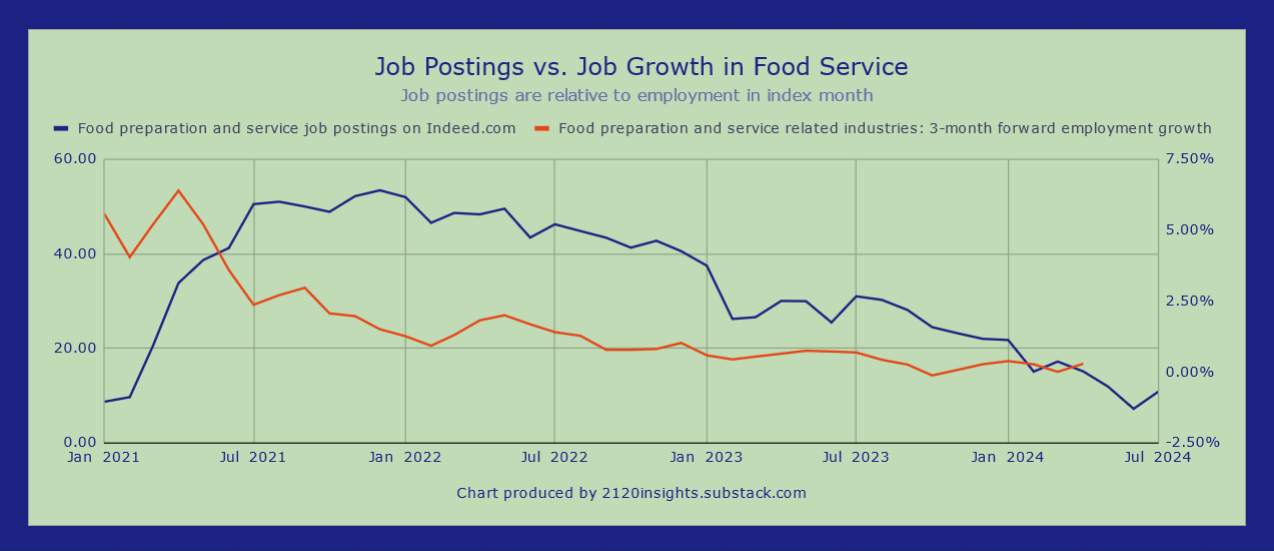

If this indicator isn’t getting the attention it deserves, it may be because of its history. It is a fairly new one, which wasn’t published until February 2020, which was… rather unfortunate timing. While it remained a good signal of how much interest there was in hiring throughout the pandemic, the course of the pandemic was much more indicative of how the actual job numbers would change in future months. Even during the recovery in 2021 and early 2022, so many workers quit during the Great Resignation that the number of job openings went up even as growth in employment fell in some sectors. The food service sector is a great example of how the relationship between job postings and employment growth can actually reverse itself in a very hot labor market.

Indeed offers a breakdown of job postings for 30 different sectors. 19 of them appear to be at least slightly predictive of job growth 3-6 months in the future, and 11 of them are at least moderately predictive!

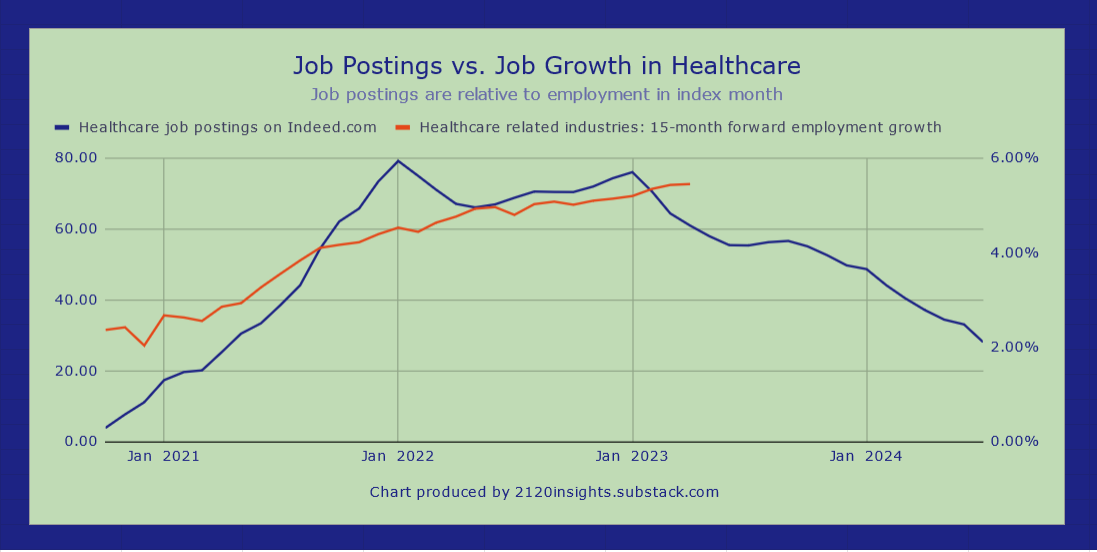

One of the strongest and most forward-looking correlations has been between the level of job postings in healthcare and growth in healthcare-related industries. These closely tracked each other from October 2020 to early 2023, but we are are now at a critical juncture: if the level of healthcare job postings from 15 months ago is still indicative of today’s employment trends (presumably due to longer hiring timelines in this industry), we should see job growth in healthcare-related industries cooling off very soon.

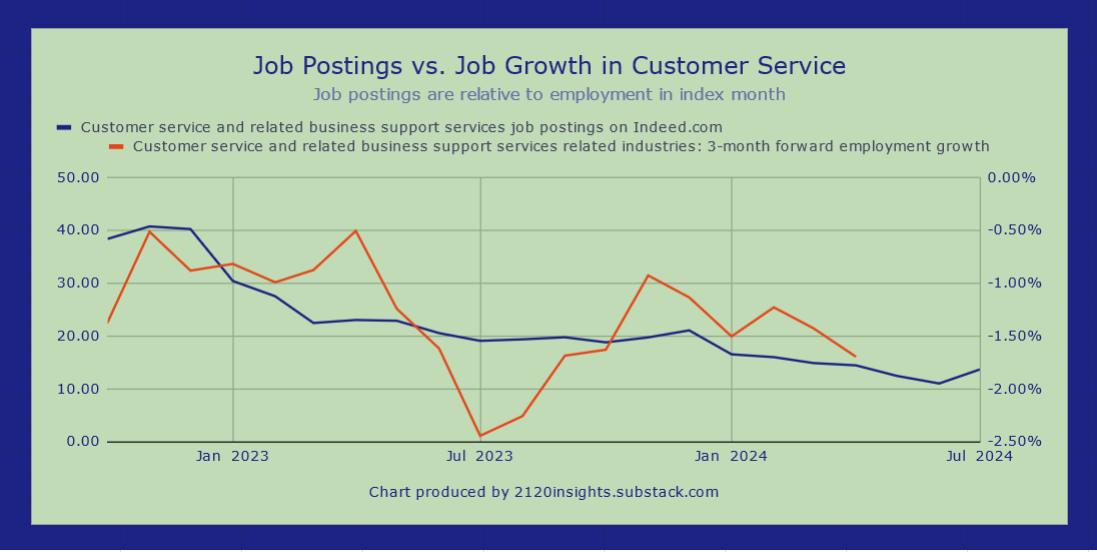

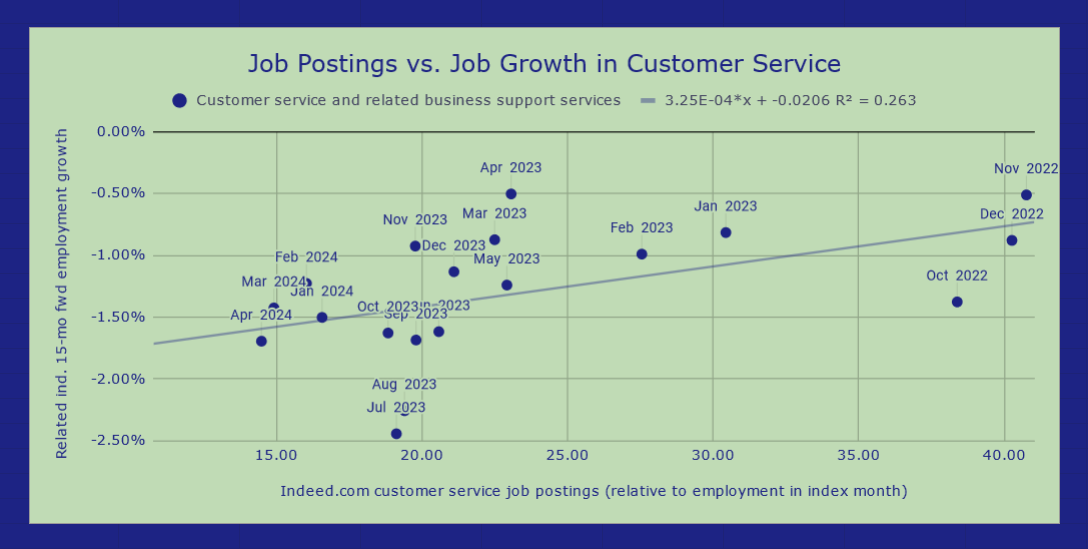

That we can with some reliability see a few months into the future of dozens of broad occupational groups might give us some clues into early signs of AI and other technologies that are disrupting work. With some companies claiming that their customer service chatbots are already handling the work of hundreds of employees, can we see this trend in Indeed’s customer service job postings?

Yes! Linear regression analysis confirms that the level of job postings is at least slightly correlated with the declining employment 3 months later in the Business Support Services industry which we explored last time.

The impacts of new technology are nearly as difficult to forecast as changes in politics and the financial markets. But prices, whether for shares of stock, or shares in a prediction market are a signal of where the rubber meets the road. Significant increases or decreases in job postings are a good real-time signal of companies’ commitments to hire a few months into the future. While it is important to recognize when the usual rules no longer apply, the advantage of being in a steady-state jobs market is that we should be able to see the signs of new technology reshaping the economy a few more months in advance than we might have otherwise. This can make all the difference to those who are making longer-term forecasts.

Having better information about the jobs market ahead can help those who are starting their careers (or thinking about a switch) make a more informed decision. Catching a trend just a few months earlier can have a big impact. The Bureau of Labor Statistics’ 10-year projections, which are used by many job seekers and guidance counselors alike, have historically struggled with forecasting the impact of some new technologies. We’ll take a closer look at their 2033 forecast when it comes out next week, along with a deeper dive into how these projections have performed in the past.

Relative to employment in the index month of February 2020. In the original metric, February 2020 is set to 100. In my charts, I set this to 0 and adjust for employment changes in the industries most closely related to this sector. For example, suppose job postings have growth to 121 from their original 100 in February 2020, but employment in related industries has also grown by 10% since then. Given the 10% growth, 110 is the new 100 (or zero, as I have set it). 121 is 11 above 110, or 10% above. According to my index, job openings would be at 10 since they are 10% above the employment growth-adjusted original index.

Why measure in this way? For a sector that has grown or declined significantly since 2020, a return to a level of 100 means something quite different than for a sector where there wasn’t much of a change in employment. Measuring the job postings index in this way means that a zero should mean a similar percent increase in employment as what was observed just before the pandemic.